Have you ever thought about having a breast reduction but stopped at the question: does insurance cover it? That question shows up a lot during consultations. If you deal with back pain, skin rashes, or can’t move comfortably, it feels far from just a cosmetic issue.

Maybe you’ve tried switching bras, gone through physical therapy, taken meds — and nothing changed. The heaviness stays, sleep feels harder, and getting dressed turns frustrating. Even so, insurance tends to treat it like it’s just about looks.

This article breaks down what usually makes a difference when a plan says yes or no. If you’ve found yourself wondering whether breast reduction covered by insurance applies to you, this might be the first step to understanding how it works — and what can make your request stronger.

Understanding how insurance views breast reduction surgery

When asking if breast reduction covered by insurance applies, it helps to look at how insurers define the purpose of the procedure.

Insurance plans often split surgeries into two categories: cosmetic or medically necessary. A procedure done only to change appearance likely ends up denied. But if pain, physical limitations, or chronic skin conditions show up in your records, the discussion changes.

Even when symptoms sound obvious, the plan might ask for proof. Back pain alone doesn’t guarantee approval. Insurers want to see long-term issues — ones that didn’t improve with non-surgical treatments.

The question shifts from do you want the surgery? Does your body need it to function better? And that’s where documentation makes a difference. For breast reduction covered by insurance, the reasons need to go beyond personal discomfort or body image concerns. The plan looks for signs that your health depends on it.

Each policy has its own rules. Some request BMI limits. Others focus on the amount of tissue removed. A few ask for photos or medical referrals. The more you know what your insurance values, the easier it becomes to check if breast reduction covered by insurance fits your case.

Read more:

👉 Are you a good candidate for breast reduction?

Conditions that might support coverage

Several symptoms can support the need for a breast reduction. Here’s what many insurers want to see:

- Chronic pain in the shoulders, neck, and upper back

- Skin rashes or infections under the breast fold

- Deep grooves in the shoulders from bra straps

- Posture issues and frequent tension headaches

- Limitations in exercise or daily movement

- Emotional distress due to breast size

Women often ask if breast reduction covered by insurance includes psychological factors. In some cases, it does—especially if supported by a mental health evaluation.

Some may think breast reduction covered by insurance relates only to pain, but insurers also consider how long the symptoms have lasted and how severe they are.

What insurance companies typically require

The question usually comes right after the consultation: what will the insurance ask for? Understanding these criteria may help avoid surprises during the process.

Medical reports and detailed diagnosis

Insurance companies need to understand how breast size affects your health. A solid start involves medical reports from specialists like orthopedic doctors, dermatologists, or mental health providers.

These documents should explain:

- How long symptoms have been present

- How breast size impacts your daily life

- What treatments have already been tried

- Which issues still remain

Non-surgical treatments already attempted

Before approving surgery, most insurance plans want proof that you’ve tried other options first. The most common ones include:

- Physical therapy for posture or back pain

- Supportive or custom-fitted bras

- Anti-inflammatory or pain medications

- Topical treatments for skin irritation

If none of these methods worked, surgery might become the next logical step.

How to start the insurance process

The question has come up, the symptoms haven’t gone away, and now it’s time to take action. Once you start thinking about insurance coverage, the next step usually involves a detailed consultation, proper documentation, and a close look at what your plan requires.

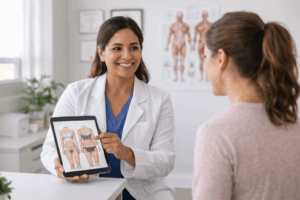

Consultation with a board-certified plastic surgeon

Everything begins at the surgeon’s office. The doctor evaluates your physical symptoms, checks for skin marks, posture problems, movement restrictions, and estimates how much breast tissue could be removed. Your BMI might also be reviewed, since some insurers use it as a guideline for eligibility.

The more thorough the evaluation, the more solid the medical report becomes—and that report plays a big part in your case.

Gathering the documents for pre-authorization

After the consultation, the clinic usually prepares the full file to submit to the insurance provider. This packet often includes:

- Clinical photos

- A description of symptoms and history

- Records of past treatments

- Surgical estimate with tissue weight

- Additional reports from other specialists

With everything in place, the clinic sends the pre-authorization request. Sometimes the plan asks for more information before making a decision. A well-prepared file gives you a better chance of getting approval for breast reduction covered by insurance without unnecessary delays.

If the request gets denied, there’s still room to appeal. But starting strong from the beginning helps avoid extra steps and frustration along the way.

Insurance doesn’t always approve—here’s why

Even when medical needs are clear, denials happen. Common reasons include:

- The provider considers the procedure cosmetic

- The documentation isn’t detailed enough

- Your symptoms don’t meet the severity threshold

What to do if insurance denies coverage

If your insurance says no, there are still steps you can take:

- File an appeal with added documentation

- Ask your doctor for a second opinion

- Review your plan’s language to understand the decision

Even with evidence, breast reduction covered by insurance might be denied. Knowing how to respond can make all the difference.

When denied, patients often ask how to re-qualify to have breast reduction covered by insurance—and many succeed on appeal.

Out-of-pocket costs when insurance doesn’t cover

For those unable to get breast reduction covered by insurance, knowing the cost breakdown helps with planning.

In the U.S., out-of-pocket expenses range between $6,000 and $15,000. This often includes:

- Surgeon’s fees

- Anesthesia

- Facility use

- Post-op garments

Some clinics offer payment plans or financing options.

Why choose Illusions Plastic Surgery in West Palm Beach?

At Illusions Plastic Surgery, we guide patients through every step, especially those unsure whether breast reduction covered by insurance applies to them.

We work with most major insurance providers and help organize the required documentation. Our board-certified surgeons focus on both function and form, providing results that relieve symptoms and improve self-image.

Ready to learn more? Our team helps you figure out if breast reduction covered by insurance might apply in your case. Schedule your consultation today and let’s walk through the process together.